Blended Rate Calculator

A Blended Rate Calculator helps you calculate the average interest rate for a loan that is made up of multiple different loan components or sources, each with its own interest rate. This is typically used when you refinance, consolidate loans, or if you have a mortgage that combines two different interest rates (e.g., part fixed-rate and part variable-rate). The blended rate is important because it gives you a single, combined interest rate for the loan.

How to Calculate the Blended Rate:

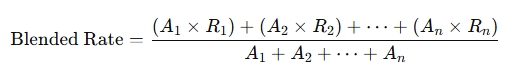

The blended rate is calculated using a weighted average of the interest rates based on the amount of money that is being borrowed at each rate. Here's the formula:

Where:

A1, A2, ..., An are the amounts of money borrowed at each interest rate.

R1, R2, ..., Rn are the respective interest rates.

Steps to Calculate the Blended Rate:

Identify the Amounts and Rates: For each loan or loan component, you need to know the amount borrowed and the interest rate applied.

Multiply Each Loan Amount by Its Interest Rate: This will give you the total interest costs for each component.

Add the Results: Add together the total interest costs for all components.

Divide by the Total Loan Amount: Divide the sum of the interest costs by the total loan amount to find the blended rate.

Example:

Let's say you have two loans with the following details:

Loan 1: $50,000 at 4% interest.

Loan 2: $30,000 at 6% interest.

The blended rate calculation would look like this:

Multiply Amount by Interest Rate:

Loan 1: $50,000 × 4% = $2,000

Loan 2: $30,000 × 6% = $1,800

Add the Total Interest Costs:

$2,000 + $1,800 = $3,800

Divide by Total Loan Amount:

Total Loan Amount = $50,000 + $30,000 = $80,000

Blended Rate = $3,800 ÷ $80,000 = 0.0475 or 4.75%

When to Use a Blended Rate Calculator:

Refinancing: If you refinance several loans into a single loan, the blended rate will give you an overall idea of what interest rate you'll be paying.

Consolidation: If you consolidate multiple smaller loans, the blended rate will be useful for understanding the average interest rate of the new loan.

Mortgages: For mortgages with different rate structures (like a combination of fixed and variable rates).