Total = Principal x (1 + Rate)Years

Total = Principal x (1 + Rate)Years

A Compound Interest Calculator is a tool that helps you calculate the interest earned or paid on a principal sum of money, where the interest is compounded periodically over time. Compound interest is the interest on both the initial principal and the accumulated interest from previous periods.

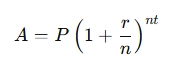

Formula for Compound Interest:

The basic formula to calculate compound interest is:

A = The future value of the investment/loan, including interest

P = The principal investment amount (the initial deposit or loan amount)

r = The annual interest rate (decimal form, so 5% becomes 0.05)

n = The number of times interest is compounded per year (e.g., monthly = 12, quarterly = 4)

t = The time the money is invested or borrowed for, in years

Key Inputs for a Compound Interest Calculator:

Principal (P): The initial amount of money invested or borrowed.

Annual Interest Rate (r): The yearly interest rate expressed as a percentage (e.g., 5% annual interest rate = 0.05).

Compounding Frequency (n): The number of times interest is applied to the principal in one year. For example:

Annually: 1 time per year

Quarterly: 4 times per year

Monthly: 12 times per year

Daily: 365 times per year

Time (t): The number of years the money is invested or borrowed for.

Key Outputs of a Compound Interest Calculator:

Future Value (A): The total value of the investment or loan after interest has been applied for the specified time period. This includes the original principal and the compounded interest.

Interest Earned: The amount of interest earned or paid, which is the difference between the future value (A) and the principal (P).

How It Works:

The formula calculates how much the initial amount (principal) grows over time based on the compounding frequency.

The more often the interest is compounded (monthly, daily, etc.), the more interest will be earned on the initial amount, because interest is calculated on the accumulated interest as well as the principal.

Example:

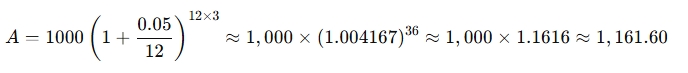

Let's say you invest $1,000 at an interest rate of 5% per year, compounded monthly, for 3 years.

Using the formula:

P = 1,000

r = 0.05

n = 12 (monthly compounding)

t = 3

The formula would calculate the future value:

Why Use a Compound Interest Calculator?

Understand Investment Growth: It helps you estimate how much your savings or investments will grow over time with compound interest.

Compare Investment Options: By adjusting the interest rate, compounding frequency, or time period, you can compare different investment scenarios and understand which one offers the best growth potential.

Plan for the Future: It helps you set financial goals by showing how much you need to invest today to reach a specific future amount, or how long it will take to grow your money to a certain amount.

Loan Interest Calculation: It's also useful for understanding how much you'll pay on a loan with compound interest, such as mortgages, credit cards, or student loans.