Return On Portfolio (Three Securities) Calculator

A Return on Portfolio of up to Three Securities Calculator helps you determine the overall return on a portfolio consisting of up to three different securities (such as stocks, bonds, or other investments). It takes into account the individual returns of each security and their respective weights (i.e., how much of the total portfolio is invested in each security) to calculate the total return on the entire portfolio.

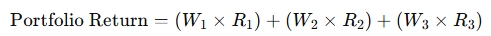

The formula to calculate the return on a portfolio is:

Where:

W1 ,W2 ,W3 = The weights of securities 1, 2, and 3 in the portfolio (as a percentage of the total investment, and they should add up to 1 or 100%).

R1 ,R2 ,R3 = The return rates of securities 1, 2, and 3.

Steps to Calculate:

Identify the returns of each security.

Determine the weight (percentage of the total portfolio) of each security.

Multiply the return of each security by its weight in the portfolio.

Sum the results to get the overall portfolio return.

Example:

If you have:

Security 1 with a return of 5% and weight of 40%,

Security 2 with a return of 8% and weight of 35%,

Security 3 with a return of 10% and weight of 25%,

The portfolio return will be:

Portfolio Return=(0.40×5%)+(0.35×8%)+(0.25×10%)=2%+2.8%+2.5%=7.3%

This means the total return on your portfolio would be 7.3%.