Sinking Fund Depreciation Calculator

A Depreciation – Sinking Fund Method Calculator is a tool used to calculate the depreciation of an asset while setting aside a fixed amount of money each year into a "sinking fund" — an investment meant to replace the asset at the end of its useful life. This method combines regular depreciation with interest earned on the invested funds.

How it works:

Asset Cost – The initial purchase price of the asset.

Salvage Value – The estimated value of the asset at the end of its useful life (can be zero).

Useful Life – The number of years the asset is expected to be in use.

Interest Rate (%) – The annual rate of return on the sinking fund investment.

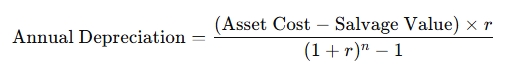

Formula:

The annual sinking fund installment is calculated using:

Where:

r = Annual interest rate

n = Number of years of the asset's useful life

The money set aside each year earns interest, and by the end of the asset's life, the total accumulated amount (principal + interest) equals the cost of replacing the asset.

Example Calculation:

Asset Cost: $50,000

Salvage Value: $5,000

Useful Life: 5 years

Interest Rate: 5%

The calculator determines the fixed annual deposit into the sinking fund so that, with interest, it reaches the asset's replacement value by the end of its life.