Straight Line Method Depreciation Calculator

A Straight Line Method Depreciation Calculator is a simple tool that helps calculate the fixed annual depreciation of an asset over its useful life. The Straight Line Method (SLM) spreads the cost of an asset evenly over its lifespan — meaning the same depreciation amount is charged each year.

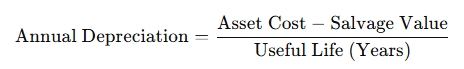

Formula:

Where:

Asset Cost = Original purchase price of the asset

Salvage Value = Estimated value of the asset at the end of its useful life (can be zero)

Useful Life = Number of years the asset is expected to be in use

How it works:

The same amount of depreciation is charged every year.

The book value of the asset reduces evenly over time until it reaches the salvage value (or zero).

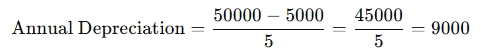

Example:

Let's say:

Asset Cost: $50,000

Salvage Value: $5,000

Useful Life: 5 years

The annual depreciation would be:

So the depreciation charge is $9,000 each year.

Benefits of the Straight Line Method:

Easy to calculate and apply

Predictable and consistent expense over time

Works well for assets with uniform wear and tear